ayurvedic hair oil gst rate

We request the government for a review of the GST rate for the. Preparations for permanent waving or straightening.

Gst Rate In India A Complete List Of Essential Commodities

Kindly consult the professional before forming any opinion.

. PERFUMED HAIR OIL Products Include. You can search GST tax rate for all products in this search box. Preparations for use on the hair such as Shampoos.

There may be variations due to updates by the government. You are adviced to double check rates with GST rate book. HSN Code3304 3305 3306 -Skin care herbal products.

16 rows PRPNS FOR PERMNT WAVING OR STRAIGHTENING Products Include. - As such the product Himsa Plus Oil is predominantly a hair oil ie. The above result is only for your reference.

Hair cream Hair dyes natural herbal or synthetic other than Hair oil other than 33059011 33059019 28 33051010 33051090 33052000 33053000. Vijayprakash P 1308 Points Replied 25 July 2020. Classification of goods - rate of GST - Himsa Plus Oil which is a ayurvedic hair oil used for various hair disease and headache - beauty product or medicinal products - The product Himsa Plus Oil is poured on hair for beautification or promoting attractiveness as the same is in the nature of cosmetics.

Hubcoin shall not be responsible for any damages or problem that may arise to you on relying on the above search results. DIGITAL DUPLICATOR Products Include. 5 customer reviews Please personal message for more details.

500 out of 5. Patanjali Ayurveda the wellness grocer that has upended Indias well-settled consumer goods leader board is unhappy with the tax slab proposed for its products under the Goods and Services Tax GST plan the introduction of which would more than double the levy to 12. Preparations for permanent waving or straightening.

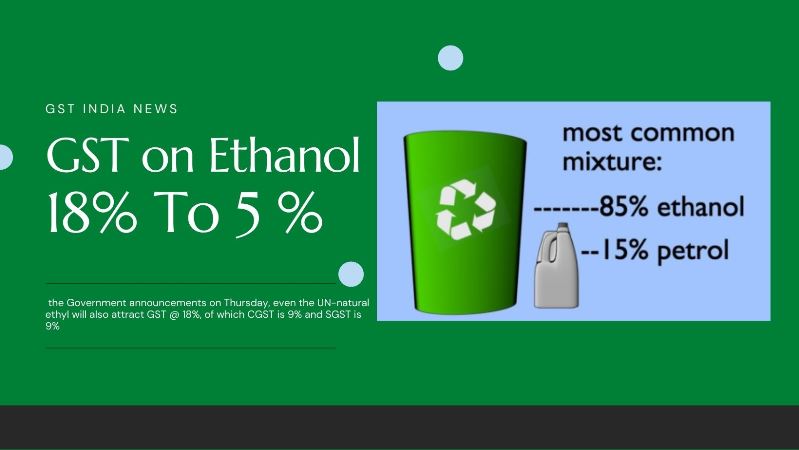

Tax rates are sourced from GST website and are updated from time to time. DABUR ALMOND HAIR OIL 100ML DABUR INDIA LIMITED AYURVEDIC PRODUCT 1200 33059011. GST on Ayurvedic products revised from 12 to 5.

Is GST applicable on exports in India. GST rates for all HS codes. Account Bird 157 Points Replied 25 July 2020.

You have to only type name or few words or products and our server will search details for you. The rate of tax of products covered under the head of Medicaments is 12 the same product when seen with the eyes of cosmetics corresponds to 18 and even 28 in certain cases. 27aqrpk9229n1zv We are Authorized Wholesale Dealer Supplier Distributor and Retailer of Ayurvedic Medicines Products - Diabetes Medicines Acidity Medicines Piles Medicines Ayurvedic Hair Oils Health Tonics General Products etc.

OTHER HAIR OIL Products include. 33059030 - Hair oil. Inlcudes Harmonized Tariff Schedule.

Hair cream Hair dyes natural herbal or synthetic other than Hair oil Note. Sankaranarayanan FREELANCER 22 Points. DisclaimerRates given above are updated up to the GST Rate notification no.

Ms Wire Products Include. Odonil Beauty Products Fmcg Ayurvedic Hair Oil. Ad Buy the best effective Ayurvedic Products at the best prices.

Hair Oil Indulekha Hair Oil Herbal Hair Oil. Ok Thanks mistakenly I saw ayurvedic products hsn code. Hair cream Search List of Indian ITC HS Code and HS classification System Code Harmonised System product code Exim Codes Lookup and HS Code Finder.

This hsn code showing 12 Tax rate. Know what else have been changed. Vinya Ayurveda Hair Oil 100ml Inc GST Category.

The export duty for Herbal Hair Oil is paid by the exporter of the Herbal Hair Oil. The above result is only for your reference. Preparations for use on the hair such as Shampoos.

052020 dated 16th October 2020 to the best of our informationWe have sourced the HSN code information from the master codes published on the NICs GST e-Invoice system. Kindly note that we are not responsible for any wrong information. Haldi Powder Moringa Oleifera Leaf Moringa Leaf Extract Herbal Tea Dietary SupplementAyurvedic Medicine Amla Powder Ginger Extract Ashwagandha Herbal Extract Cordyceps Militaris.

17 rows GST Rates HSN Codes for Cosmetics Essential Oils Perfumery - Essential oils terpeneless or. GST Classification of Ayurvedic Beauty and Make-up Preparations. GST Rate Schedule for Goods.

Yes GST is applicable on exports in India and is 5 12 18 and 28 depending upon HS Code of Herbal Hair Oil.

Gst Rates Here S Your Complete Guide Discountwalas

Hsn Code Gst Rate For Cosmetics Essential Oils Perfumery Chapter 33 Tax2win

Gst Rates In India Gst Rate Finder Item Wise Gst Rate List In Pdf

Gst Rates For Goods And Services Taxdose Com

Gst Rate Slabs Under Gst Law Goods And Services Slab Goods And Service Tax

Gst Tax Rates India 2017 Full List For All Goods And Services

Iiem Indian Institute Of Export Management Gst Rates Schedule For Goods Announced On 18 05 2017 Following List Shows Rates For Salient Items For Entire List Of Items Visit Http Iiem Com News Resources Comment Below If

![]()

All Gst Hsn Code And Rates In Excel

Gst Rates Here S Your Complete Guide Discountwalas

Gst Rate In India A Complete List Of Essential Commodities

Gst Regime Emami Hair Oil Gets Cheaper As Company Passes On Tax Benefits Business Standard News

Gst Tax Rate What Are Rate Of Taxes Under Gst Taxmann Blog

Gst Rate For Perfume Cosmetics And Toiletries Indiafilings

Gst Rate Changes For The Year 2020 2021 Vakilsearch

Overall Structure Of Goods And Services Tax In A Nutshell

Gst On Ayurvedic Products Revised From 12 To 5 Know What Else Have Been Changed

Gst Rates Know Gst Rates In India Tax Exempt Items Slabs More

Gst Rates For Goods And Services With Hsn Company Suggestion